When faced with financial challenges, many people turn to loans as a solution to their problems. Secured loans are a popular choice for individuals who are looking for a way to secure funds for various purposes, such as home improvements, debt consolidation, or other financial needs. Understanding the benefits of a secured loan can help individuals make informed decisions about their financial needs and find the best loan solution for their circumstances.

What is a Secured Loan?

A secured loan is a type of loan that is backed by collateral, such as a home, car, or other valuable asset. This means that if the borrower fails to repay the loan, the lender has the right to repossess the collateral to cover the outstanding debt. Due to the collateral, secured loans generally offer lower interest rates and higher borrowing limits compared to unsecured loans. This makes them an appealing option for individuals who need a large sum of money and are willing to use their assets as security.

Benefits of a Secured Loan

Lower Interest Rates

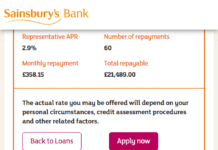

One of the most significant benefits of a secured loan is the lower interest rates that are typically offered. Lenders are more willing to offer competitive interest rates on secured loans because they have the security of the borrower’s collateral. This can result in substantial savings over the life of the loan compared to unsecured loans or other forms of financing, making it an attractive option for many borrowers.

Higher Borrowing Limits

Secured loans often come with higher borrowing limits compared to unsecured loans. Because the loan is secured by collateral, lenders are more willing to lend larger amounts of money to borrowers who are able to pledge valuable assets. This can be beneficial for individuals who need a substantial amount of money for major expenses, such as home renovations, starting a business, or paying for a wedding.

Flexible Repayment Terms

Another benefit of a secured loan is the flexibility in repayment terms that are often offered by lenders. Borrowers can typically choose from a variety of repayment options, such as fixed, variable, or interest-only payments, to suit their financial circumstances. Additionally, the longer the repayment term, the lower the monthly payments may be, making it easier for borrowers to manage their finances while paying off the loan.

Improved Credit Scores

Taking out a secured loan and making timely payments can have a positive impact on a borrower’s credit score. As long as the borrower keeps up with their loan repayments, it shows that they are responsible and capable of managing their debts. This can help to improve their creditworthiness and make it easier for them to access credit in the future.

Variety of Loan Purposes

Secured loans can be used for a variety of purposes, making them a versatile financial tool for individuals. Whether it’s for home improvements, debt consolidation, purchasing a car, or covering unexpected expenses, a secured loan can provide the necessary funds to meet a borrower’s financial needs. This makes it an attractive option for individuals who require a substantial amount of money for a specific purpose.

How to Obtain a Secured Loan

To obtain a secured loan, individuals will need to provide collateral, such as their home, car, or other valuable assets, to secure the loan. Lenders will typically assess the value of the collateral and the borrower’s ability to repay the loan before approving the loan application. Once approved, the borrower will receive the funds and be required to make regular repayments according to the agreed-upon terms.

It’s important to carefully consider the terms and conditions of a secured loan before proceeding with the application. Borrowers should be aware of the risks involved, such as the potential loss of their collateral if they are unable to repay the loan. Seek the advice of financial advisors or mortgage brokers to ensure that a secured loan is the right choice for your financial needs and to find the best loan solution for your circumstances.

In conclusion, secured loans offer numerous benefits for individuals who are in need of funds for various financial purposes. The lower interest rates, higher borrowing limits, flexible repayment terms, improved credit scores, and versatility in loan purposes make secured loans an attractive option for many borrowers. However, it’s essential to thoroughly understand the terms and conditions of a secured loan and the potential risks involved before applying. By carefully considering your financial circumstances and seeking professional advice, you can make an informed decision about whether a secured loan is the right choice for your financial needs.